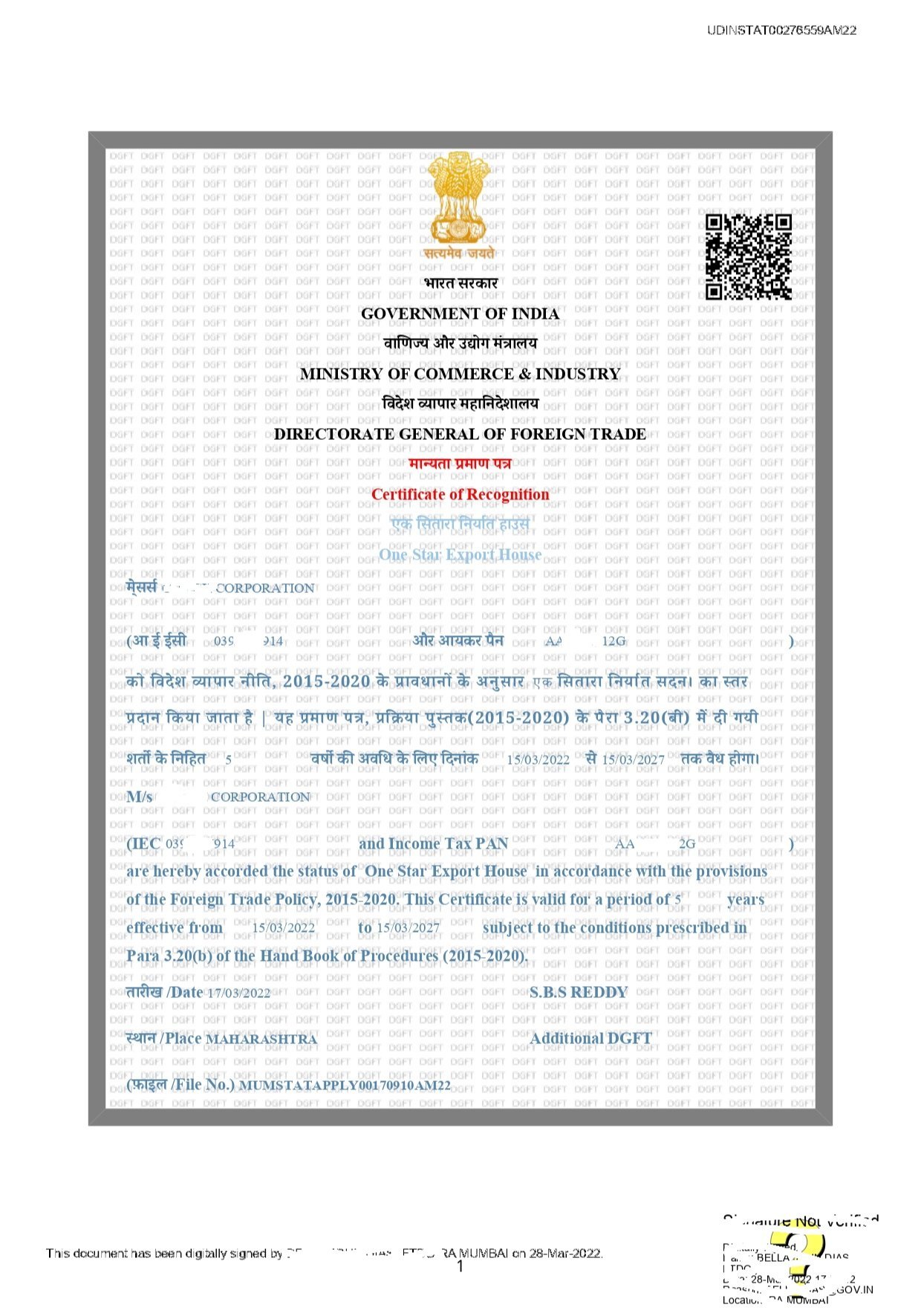

This Certificate/Status is granted to business leaders who have excelled in international trade and have successfully contributed to the country’s foreign trade. The Export house status is issued to all the exporters of goods, services, and technology who have an Import- Export Code (IE Code). The exporter may become a Status Holder by applying for a Status Holder Certificate. If your application for the requested Status House is approved, you shall be issued a Status Holder Certificate.

Foreign Trade Policies aim at simplifying and making the import-export process desirable to the importers, exporters, and traders. There are several schemes for encouraging exports, Export House Certificate or the Status Holder Certificate is one amongst them. The Export House Certificate aims to boost export performances. As per the scheme, exporters are allotted status holder positions according to the export performance.

Export House Certificate holders are the Indian businesses that have given excellent performance in international trade and have made a significant contribution to the country’s foreign exchange earnings.

Export House Certificate is provided as recognition to those who have performed excellently throughout the financial year (FOB/ FOR value).

- The calculation of Export performance is based on the FOB (Free on Board) value of export earnings in free foreign exchange.

In the case of deemed exports, it converts the FOR value of exports in Indian rupees into USD at the exchange rate by the Central Board of Excise and Customs, as applicable for 1st April of each financial year.

The eligibility criteria to recognize an exporter as a “status holder exporter”:

- The certificate is given depending upon the certain level of export performance achieved by the exporters.

The applicant can get status holder recognition in any of the five categories from One Star Export House to Five Star Export House. Your export performance FOB/FOR value for them should be $3 million, $15 million, $50 million, $200 million, and $800 million, respectively.

Benefits

- Authorization and Customs Clearances for both imports and exports may be granted on self-declaration basis.

- Manufacturer exporters who are also Status Holders shall be eligible to self-certify their goods as originating from India.

- Input-Output norms may be fixed on priority within 60 days by the Norms Committee

- Exemption from furnishing of Bank Guarantee in Schemes under Foreign Trade Policy

- Exemption from compulsory negotiation of documents through banks.

- Two star and above Export houses shall be permitted to establish Export Warehouses as per Department of Revenue guidelines.

- Three Star and above Export House shall be entitled to get benefit of Accredited Clients Programme (ACP) as per the guidelines of CBEC.

- Status Holders/Star Export houses are entitled to export freely exportable items on a free of cost basis for the export promotion purpose subject to the annual limit as specified (Excluding Gems and Jewellery, Articles of Gold and precious metals).

- Three Star/Four Star/Five Star status holders (Manufacturer Exporters) will be enabled to self-certify their manufactured goods as originating from India (Certificate of origin) to qualify for preferential treatment under following.

- Preferential trading agreements (PTA),

- Free Trade Agreements (FTAs),

- Comprehensive Economic Cooperation Agreements (CECA)

Comprehensive Economic Partnership Agreements (CEPA). - Compulsory negotiation exempted for export documents through banks and entitled to preferential treatment and priority in the handling of import-export consignments.

- Three Star and above star holders shall be directly entitled to AEO Benefits.

- There are various Government Schemes under which status holders are given access to loans easily.

- Status holders shall be entitled to export freely exportable items on free of cost basis for export promotion subject to an annual limit of Rs 10 lakh or 2% of average annual export realization during preceding three licensing years whichever is higher.

Grant of Double Weightage :

(a) The exports by IEC holders under the following categories shall be granted double weightage for calculation of export performance for grant of status.

(i) Micro, Small & Medium Enterprises (MSME) as defined in Micro, Small & Medium Enterprises Development (MSMED) Act 2006.

(ii) Manufacturing units having ISO/BIS Certification.

(iii) Units located in North Eastern States including Sikkim, and Union Territories of Jammu , Kashmir and Ladakh.

(iv) Units located in Agri Export Zones.

(v) Export of fruits and vegetables falling under Chapters 7 and 8 of ITC HS.

(b) Double Weightage shall be available for grant of One Star Export House Status category only. Such benefit of double weightage shall not be admissible for grant of status recognition of other categories namely Two Star Export House, Three Star Export House, Four Star export House and Five Star Export House.

(c) A shipment can get double weightage only once in any one of above categories.

The following documents required for Star Export House Certificate.

- Application Form –ANF 3C

- Submitting Hard copy of ANF3C

- CA Certificate as per Annexure to ANF 3C,

- Statement of Export, Certified by Chartered Accountant (CA),

- Self-certified copy of IEC,

- Self-certified copy of valid RCMC,

- Self-certified copy of PAN.

How we can help to obtain:

- We help our client in the compilation of exports made in the present FY plus the last three financial years export and analyze to check the eligibility for getting a certificate.

- Accordingly, prepare the application along with the documentation.

- Submit the application online & coordinate with DGFT till issuance of the Status Holder Certificate.

- Guiding Clients in taking advantage of the various privileges given to Star Export House Holders.

Validity :

Star Export House Certificate shall be valid for 5 Years from the date of issue of certificate. Certificate renewal shall be filed before the expiry of existing validity period.